Donor-Advised Funds

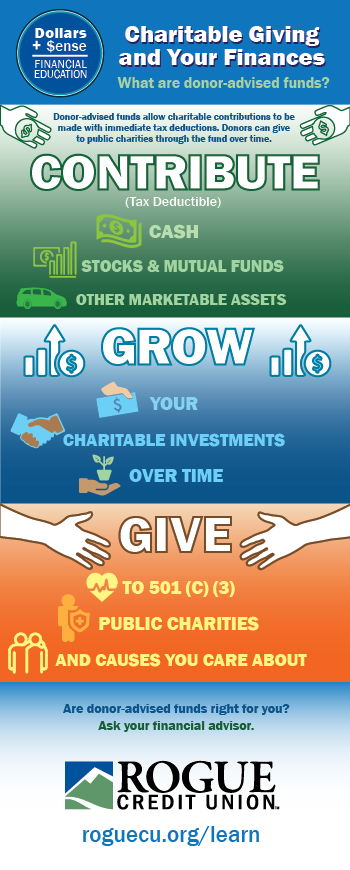

What are donor-advised funds?

- Offered through financial-services firms.

- Accept cash, mutual funds, securities, business interest, retirement accounts or even collectibles and personal property such as jewelry. You get a tax deduction for your donation to the fund.

- Once contributions are made, they are invested and grow tax-free.

- When you are ready, you can make a contribution to a 501(c)(3) charity.

Learn more tips about tackling taxes with this video!