Rogue Credit Union's History

1956

In 1956, a small group of educators joined together in the Jefferson Elementary Cafeteria and began what is now Rogue Credit Union.

From humble beginnings, the credit union began its operation out of the living room, and later the garage, of the credit union’s founding father Jim Johnston, along with the support of his wife, Harriet.

1964

The Johnston’s outgrew their 100-square-foot garage and purchased a home on the corner of Newtown and Stewart, from where the credit union would continue to operate.

The Johnston’s outgrew their 100-square-foot garage and purchased a home on the corner of Newtown and Stewart, from where the credit union would continue to operate.

1972

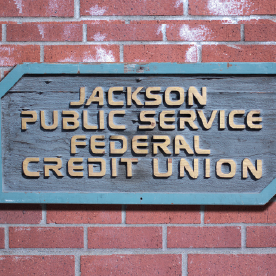

The Credit Union merged with Rogue Federal Credit Union in 1972 to become Jackson Public Service Federal Credit Union. The merger enabled the Credit Union to offer new services.

The Credit Union merged with Rogue Federal Credit Union in 1972 to become Jackson Public Service Federal Credit Union. The merger enabled the Credit Union to offer new services.

1982

The Credit Union changed its name to Rogue Federal Credit Union, merged with Jackson County Employees Federal Credit Union, and converted to a community charter which broadened the reach to serve anyone who worked or lived in Jackson County. Two years later, the first Ashland branch opened.

The Credit Union changed its name to Rogue Federal Credit Union, merged with Jackson County Employees Federal Credit Union, and converted to a community charter which broadened the reach to serve anyone who worked or lived in Jackson County. Two years later, the first Ashland branch opened.

1993

Rogue opened the first student branch in the state of Oregon at South Medford High School in 1993, which continues to offer a valuable learning experience for students while serving the members that are staff and students.

Rogue opened the first student branch in the state of Oregon at South Medford High School in 1993, which continues to offer a valuable learning experience for students while serving the members that are staff and students.

2012

After careful consideration by the board of directors, the decision was made to purchase and assume the five Oregon branches of Chetco Federal Credit Union from the NCUA and retain employment for all Chetco employees.

After careful consideration by the board of directors, the decision was made to purchase and assume the five Oregon branches of Chetco Federal Credit Union from the NCUA and retain employment for all Chetco employees.

2015

Rogue converted to a state charter and changed its name to Rogue Credit Union. Rogue also opened its first Campus branch at Southern Oregon University, its first branch in Roseburg, and a new branch in East Medford.

Rogue converted to a state charter and changed its name to Rogue Credit Union. Rogue also opened its first Campus branch at Southern Oregon University, its first branch in Roseburg, and a new branch in East Medford.

2016

2016 was a year of milestones for the credit union. Rogue grew to serve over 100,000 members, created the high-yield Ownership Account that rewards members for their participation with their credit union, deployed the Rogue Rewards Loyalty Programs, and most importantly, gave back $2.5 million dollars to its members in the form of a Loyalty Dividend.

2016 was a year of milestones for the credit union. Rogue grew to serve over 100,000 members, created the high-yield Ownership Account that rewards members for their participation with their credit union, deployed the Rogue Rewards Loyalty Programs, and most importantly, gave back $2.5 million dollars to its members in the form of a Loyalty Dividend.

2018-2019

2018 was highlighted with the opening of the South Ashland location and the return of $4 million dollars to our loyal member-owners through a Loyalty Dividend. 2019 was marked by the opening of Rogue's second Campus Branch at Umpqua Community College.

2018 was highlighted with the opening of the South Ashland location and the return of $4 million dollars to our loyal member-owners through a Loyalty Dividend. 2019 was marked by the opening of Rogue's second Campus Branch at Umpqua Community College.

2020

Rogue began the year with celebration as it returned a $6 million Loyalty Dividend to its members.

Rogue began the year with celebration as it returned a $6 million Loyalty Dividend to its members.

As the COVID-19 pandemic closed branch lobbies, the Rogue team shifted into new roles to support remote member service. To support our communities through the pandemic, Rogue distributed federal Paycheck Protection Program Funds and Oregon Emergency Relief Funds.

In May, Rogue opened its second location in the Klamath Basin, the North Klamath Falls Branch. The Rogue Credit Union Foundation raised over $1.35 million in September to support wildfire recovery efforts from the Almeda and Obenchain fires. In November, the members of Malheur Federal Credit Union voted in support of a merger with Rogue Credit Union.

Rogue ended the year with over $2.49 billion in assets and a membership base of over 165,000 members.

2021

In 2021, Rogue implemented a System Upgrade, allowing the credit union to provide the latest in financial services, technology and information security to its members. Rogue also finalized the merger with Malheur Federal Credit Union, welcoming over 14,000 new members to Rogue.

In 2021, Rogue implemented a System Upgrade, allowing the credit union to provide the latest in financial services, technology and information security to its members. Rogue also finalized the merger with Malheur Federal Credit Union, welcoming over 14,000 new members to Rogue.

2022-2023

In 2022 Rogue’s longtime and respected President/CEO, Gene Pelham, retired. Executive Vice President Matt Stephenson, who had served alongside Gene for 18 years, was named as the organization’s fifth President/CEO. The year ended with remarkable milestones of over 650 team members, 200,000 members, and $3 billion in assets. In 2023, the credit union defined its purpose: To partner with individuals and communities on their journey to financial well-being. The new South Medford Support Services building opened, bringing together teams from across the credit union.

In 2022 Rogue’s longtime and respected President/CEO, Gene Pelham, retired. Executive Vice President Matt Stephenson, who had served alongside Gene for 18 years, was named as the organization’s fifth President/CEO. The year ended with remarkable milestones of over 650 team members, 200,000 members, and $3 billion in assets. In 2023, the credit union defined its purpose: To partner with individuals and communities on their journey to financial well-being. The new South Medford Support Services building opened, bringing together teams from across the credit union.

Today the credit union remains focused on providing exceptional experiences that inspire the most loyal members in the nation, now through the lens of its purpose statement. Toward that end, the credit union is investing in both in-person and digitally-delivered member services